Nomiks Newsletter

Subscribe to our Newsletter to receive the latest updates in token economics and Risk Management

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

We’ve curated case studies and use cases showing how leading protocols use Nomiks to secure their runway, design liquidity buffers, and deploy dynamic hedge strategies. Learn from their experience and apply proven treasury insights to your own organization.

From the failures of Celsius, 3AC, and BlockFi to the disciplined playbook of MicroStrategy, this article distills key lessons for Bitcoin treasury management. It outlines a modern risk framework covering VaR/CVaR, Probability of Ruin, liquidity buffers, hedging, proof-of-reserves, and stress-testing — to help institutions turn Bitcoin from a speculative gamble into a managed, resilient treasury asset.

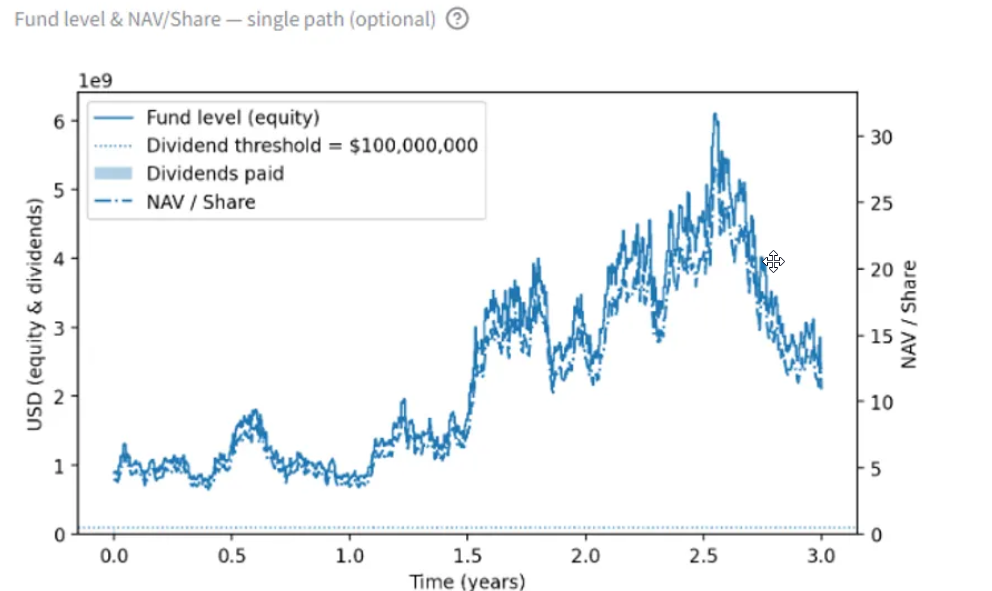

Dar Blockchain and Nomiks bring institutional-grade risk management to digital-asset treasuries. Our joint toolkit models capital stacks, waterfall payouts, ruin probabilities, VaR/CVaR, and 12-month coverage tests turning risk from static charts into actionable signals. Whether you run a Bitcoin balance sheet or a multi-sleeve fund, you get clarity on when to rebalance, hedge, or raise cash before it’s too late.

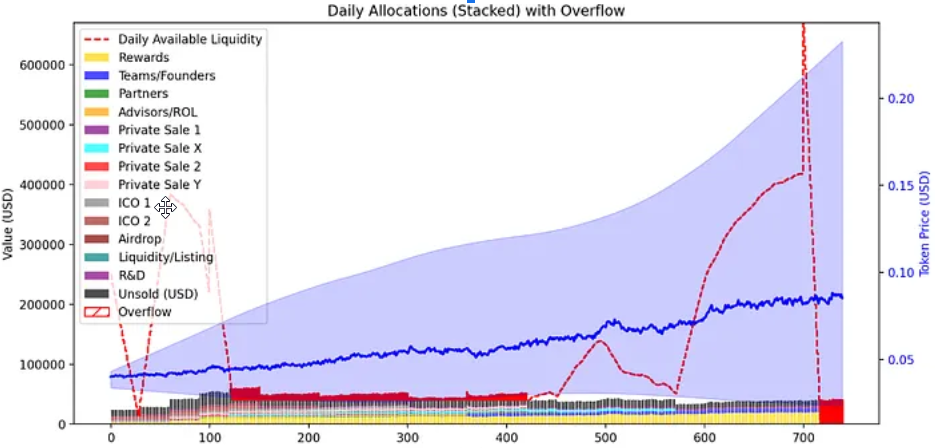

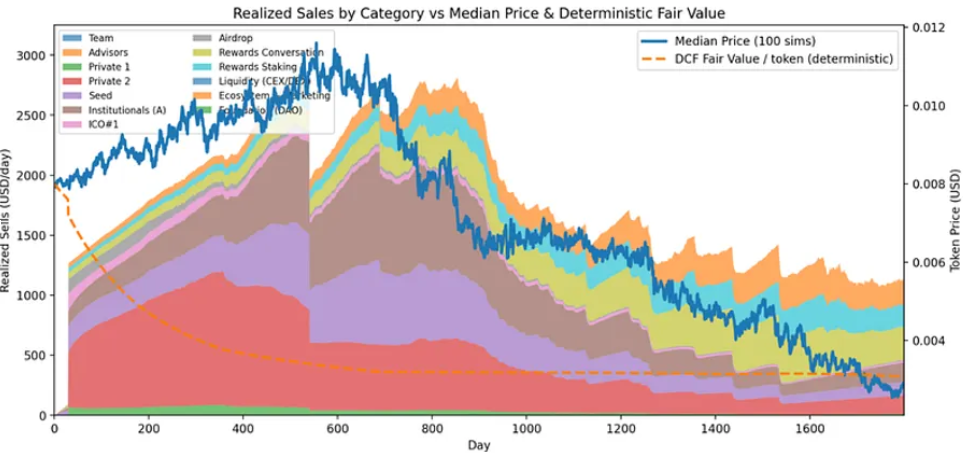

This Streamlit tool simulates token unlocks, liquidity, and market stress to help founders, investors, and analysts design resilient tokenomics. With models for stochastic pricing, overflow, vesting, and ROI; plus dynamic features like panic-driven liquidity drains and adaptive volatility; it stress-tests strategies against real market shocks, giving teams actionable insight into sustainability and investor impact.

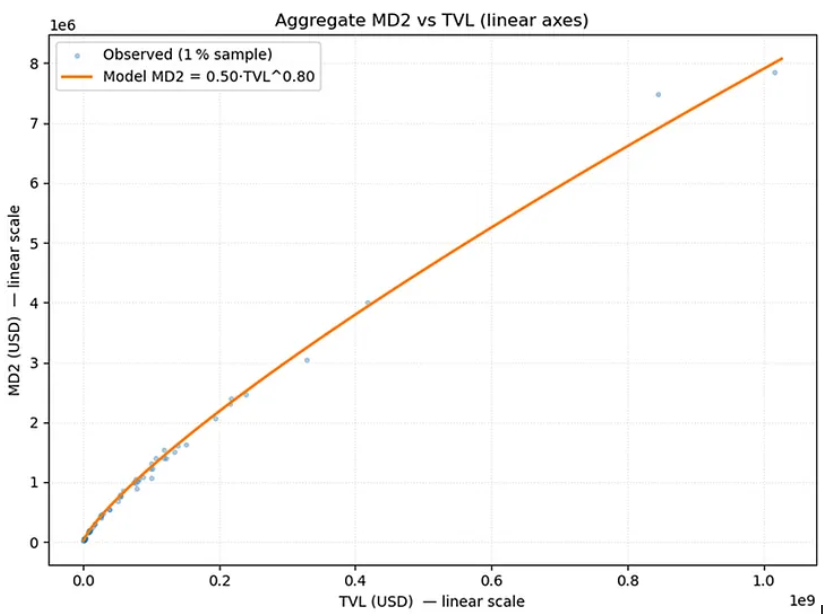

This framework links Total Value Locked (TVL) with Market Depth at ±2% (MD₂%), enabling protocols to calibrate initial reserves, dynamically provision liquidity, and reach TVL targets while managing depth costs. It turns liquidity sizing from guesswork into a measurable, optimized policy.

Unlock calendars don’t crash prices on their own; stress comes when sell intent exceeds liquidity and buybacks relative to static market depth. Our framework models desired sells, absorption, and overflow windows to show when price impact clusters, and how policy levers (vesting, liquidity windows, buybacks) can smooth outcomes pre- and post-TGE.